Now the UN Administration appears to be at it again. Several senior staff of the UN Pension Fund’s Office of Investment Management (OIM) as well as a number of UN auditors were reportedly ordered in May to hand over their laptops and cellphones to the UN's internal oversight office (OIOS).

And last month, the UN Administration reportedly asked, in writing, a former staff member/ staff representative of the Fund to comment on a complaint of defamation and harassment filed by former Pension Fund Chief Executive Officer, Sergio Arvizu, against seven UN staff representatives. The complaint relates to alleged events prior to Arvizu’s separation with a disability award from the UN in January 2019. Similar requests for comment are likely to be issued to other former and current staff representatives cited in the complaint.

The question of motive

OIM staff and auditors

It’s apparent that the investigation of OIM staff and auditors relates to the investment governance audit conducted in 2020 (A/75/215, 21 July 2020) that found serious governance shortcomings, including divisiveness and a toxic culture among staff; a concentration of power that fostered perceived or actual conflicts of interest; a lack of detailed disclosure and recusal procedures; and procurement irregularities involving “Entity A” that may be hired as an external manager for part of the Fund’s Fixed Income portfolio. Former head of investments, Sudhir Rajkumar left the UN three months prior to publication of the audit for “personal and family reasons”.

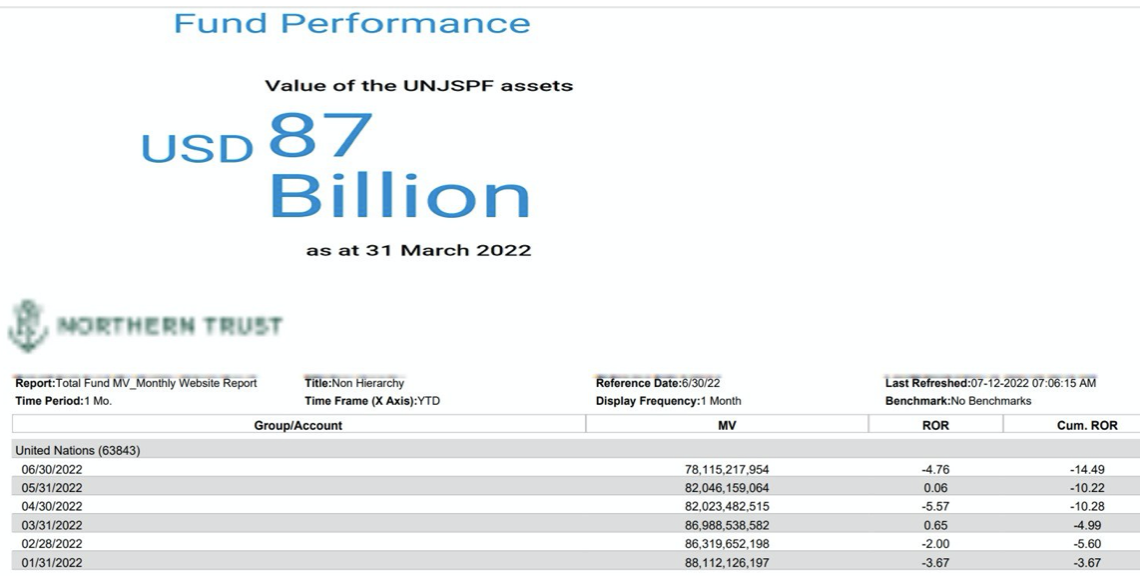

The investigation of OIM staff likely also relates to the recent heated controversy involving a decision by the current head of OIM, Pedro Guazo, to outsource a significant portion of the Fund’s fixed income investments.The decision was met with a petition by staff to Secretary-General Guterres who placed the decision on hold. A downsized outsourcing plan followed, which still amounts to about $5billion being outsourced.

Staff representatives

The reason for the “assessment” underway of UN staff representatives is a UN Administration decision not to investigate Arvizu’s complaint filed in July 2019. The decision cited, correctly, the latitude, in comments and statements, afforded staff representatives and the requirement that the Administration refrain from interfering in their activities (UN Dispute Tribunal (UNDT) judgment 2020/211, December 2020).

But on 18 March 2022, the UN Appeals Tribunal rescinded the UNDT’s judgment and remanded back to the Administration to assess Arvizu’s complaint holding that it had failed to lawfully exercise its discretionary authority “by balancing … conflicting interests and freedoms…”(UNAT judgment 1231).

An avoidable travesty

A key question is why the Administration, which made the right decision the first time around not to investigate the staff representatives, cited staff prerogatives only. A travesty could have been curtailed had the Administration presented even part of the backstory in its response. Perhaps the Administration preferred to keep the lid on that can of worms?

The Administration could have cited an array of audits that found managerial deficiencies under Arvizu’s tenure, among them unprecedented and protracted delays in benefit processing; findings that relate to conflicts of interest; and procurement irregularities (2017/002; 2017/104; 2017/110; A/73/341).

There are also related GA advisory body (ACABQ) reports, press releases containing statements of Member States (https://press.un.org/en/2017/gaab4261.doc.htm) and a series of General Assembly resolutions calling for reforms to address management and governance deficiencies reported in the audits.

Arvizu reportedly went on leave in August 2017 soon after he was informed of Guterres’ decision, on the recommendation of the Pension Board, to renew his contract for three instead of five years. Shortly thereafter he went on sick leave until January 2019 when he was separated from the UN with a disability award. Since then, he has filed a string of compensation claims with the UN internal justice system (UNDT/2020/205; UNDT/2020/208; and the claim in question, 2022-UNAT-1231. (UNDT/UNAT judgments are publicly available).

A series of ironies

It's noteworthy and ironic that the governance audit (A/73/341, paragraph 78) stated that the UN Ethics Office established that retaliation occurred in three cases of staff of the Fund Secretariat under Arvizu's tenure.

It's particularly ironic that one of the staff, who is among the seven staff representatives that Arvizu cites in his complaint, recently won her case at the UNDT and was awarded two years' net salary -- a costly payout by the UN for managerial wrongdoing (2022-UNAT-1207). The UN Administration decided nine months after Arvizu's separation that it was not going to pursue the three established retaliation cases.

Most ironic would be if the UN Administration follows through on punishing OIM staff and auditors acting on principle, or if it reverses its decision not to carry out an investigation of UN staff representatives who were dispatching their responsibilities to their constituents in safeguarding the Fund.

It’s not surprising that these actions by the UN Administration are aimed at staff representatives and auditors connected to the Fund. The Fund management and Pension Board routinely call foul on the staff representatives to the Pension Board, and UN auditors, related to audits of activities on the administrative and investments sides of the Fund, and slow-walk reforms.

In 2018, in response to the governance audit, the Pension board reported the internal auditors to the UN’s Independent Audit Advisory Committee (IAAC), apparently for unprofessionalism. That body found no justification for the complaint.

https://www.passblue.com/2018/08/27/the-un-pension-fund-board-rejects-an-audit-of-its-work/, https://www.passblue.com/2020/11/12/the-75-billion-un-pension-fund-kicking-reforms-down-the-road/

It’s also noteworthy that Internal audits consistently call out deficiencies in values of integrity and ethics, and the lack of an appropriate “tone at the top” on both sides of the Fund (governance audit, Rec. 10, A/73/341, para. 78; investment governance audit, A/75/215, para. 93).

It’s important too to note that the above events are happening in the context of growing secrecy and authoritarianism surrounding the Fund, and against the backdrop of a long history of unfair treatment of whistleblowers in the UN as the BBC documentary demonstrates.

In response to the BBC documentary, Transparency International points to "a long line of individuals who have complained of suffering retaliation for reporting abuses of power or malpractice at UN agencies" and again urges Secretary-General Guterres "to immediately order an independent inquiry and use his power to remedy the harm caused to UN staff who have already suffered for trying to do the right thing." https://www.transparency.org/en/press/un-whistleblower-exposé-independent-inquiry-urgent-reforms

The question on many minds is will Guterres heed the call or will the UN leadership continue to crack down on dedicated UN staff with the courage to do the right thing?